I’m slowly getting the difference between day trading, swing trading and investing. And the reason I’ve been pondering the differences between those 3 “disciplines” is because I guess I’ve been doing all of them. And yet one of the biggest problems I have is not sticking to the plan when making a trade. I come from the place of looking at risk:reward ratio (ones I see in the market sometimes; not backtested approach). So what I get is R:R which if makes sense along with other things then I made the trade. However, I two problems I have

- I can DT (day trade) a stock with some SL but not considering that the same stock I could hold for ST (swing trade) or investment (long term trade). It means that I can be trading a stock that actually should be a long-term hold as it may represent 15% yearly ROI. And the only way it would make sense to DT a stock that should be held long-term is only by adding additional position if yearly DT return % is higher than 15%. So if we suck at DT and let’s imagine we have yearly ROI at 1% then we might get 15% in long-term holds thus we should just park our money there. Point is that at the moment I don’t know my ROIs for DT, ST, investment. That’s my problem. And because of that I cannot be doing optimal capital allocation… But what would make sense would be to know those metrics. Given sample sizes it would be easiest to get ROI% for DT, ST and then LT (Long-term). What would make sense is to actually have 3 separate trading accounts not to mess up results. I guess I need another Schwab account…

- Another problem is not sticking the trades and modifying them. I sold ARM just before take off. And I was supposed to hold it long-term (half sell as ST profit; rest hold as long as company does things that make sense)

- I found a third problem… Not having a framework for deciding which stock should fall into which class. For me the way it starts is I look at daily charts and some stats and see where there could be a movement. I guess that’s just swing trading… However, if I do see movement potential then I also should check if there’s LT potential. Because if there is LT potential and a strong hold, then I might hold the position until I believe that I have other opportunities at higher ROI.

- My fourth problem is that third problem doesn’t have a solution. If I’m swing trading I look for R:R opportunities. Okay… but I look at charts I wrote… so wtf am I looking at charts for? I think I need a R:R scanner and just honestly sort shit. I’m not super visual so working with a table of hundreds of rows is okay. As long as numbers are meaningful then god bless. The way it would make sense would be if I start from supports. I already have data for volume profiles for different time periods updated daily. I can start there… so that’s volume based basically. For TA I should get horizontal supports (I can input them manually it’s fine) or maybe there’s some nice algo that plots them well. I can also do some fibs if they make sense. Also, % to SMA, EMA%.

Fuck, okay, let’s just list what I need

- Levels – Volume Profiles (automated)

- Levels – MAs (automated)

- Levels – Horizontal (manual)

- Levels – Diagonal (manual)

- Levels – Intraday VWAP

- Levels – vs Previous day high

- Levels – vs Previous day low

- Velocity – % vs SPY

- Velocity – cv_vs_cvps1, cv_vs_cvps2, cv_vs_cvps2_roc_1m,

- Velocity – proximity_wedge_end

- Velocity – top4_in_a_row

- Velocity – News top 5%

- Direction – 1m, 5m, 15m

- Direction – Financials

- Direction – News sentiment

- Tags – strong sentiment, cheap among peers, news, potential market overreaction, strong demand, strong growth, beta above 1.5, beta above 3

Others:

- Profit target – last 180d high or 10%

- SL 1-2% below levels average or something; but I’d manually check first anyways

- Estimated_Time_to_PT= Average Daily Gain Target Price−Entry Price

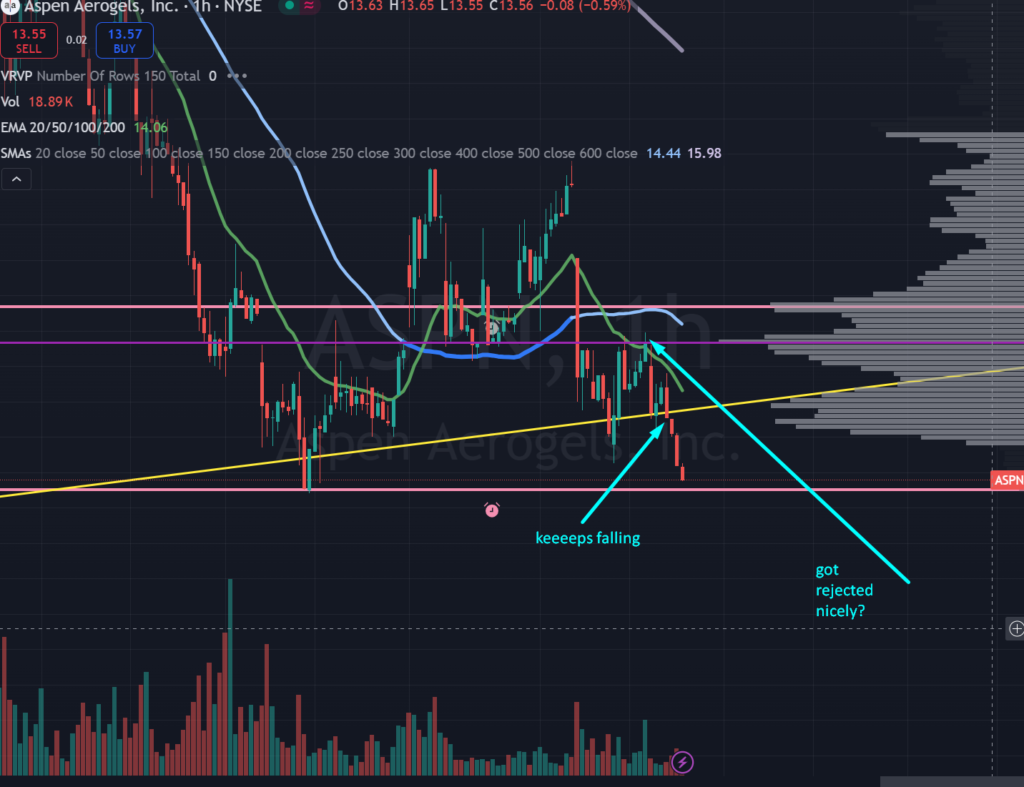

Anyways. I just think that would suit me more. And having all updated by 1min and then just filtering and having table updated every min for R:R or high score opportunities where I could change weights as well. This one I caught yay

Finally some thing that